Welcome to the Layer-2 Report, a summation of Bitcoin's second layer, spanning new innovations and projects to protocol updates and discussions happening in the space.

In this issue, the spotlight is on Fuji Money, a non-custodial Bitcoin-only lending platform currently in development. We also look closely at Lightning and Liquid growth to see how far each protocol has come in recent years.

Tracking Layer-2 Growth

Note that data was pulled from the first of July 2022.

The Lightning and Liquid networks have experienced healthy growth, with a notable uptick in network use since 2021. The latest data shows a combined capacity of 7,563 BTC—a new high despite the drawdown in Bitcoin price this year.

The number of channels on the Lightning Network (how parties send or receive payments from each other) has quadrupled to more than 85,000 since 2019. Network capacity, or the amount of bitcoin circulating on Lightning, has followed suit to climb over 4,000 BTC.

Over the same period, the number of Lightning nodes is up nearly 600%, doubling each year on average. If the trend continues, more than 40,000 Lightning nodes could be up and running by 2023.

The Liquid Network has experienced a similar rate of adoption. The number of assets issued and Liquid Bitcoin (L-BTC) peg-ins have more than doubled year-over-year. Network capacity is also steadily rising.

We can expect continued growth as Bitcoin scales and more transaction volume moves to second layers. Learn more here about how Lightning and Liquid are replacing the legacy banking system by building the payment and financial layers of Bitcoin.

Building Bitcoin’s Financial Layer

One of the most talked about announcements from the past month was Fuji, a Lightning-enabled synthetic asset protocol built on Liquid that lets users borrow stablecoins and synthetic assets and trade them trustlessly peer-to-peer.

Based on the research paper (below) by Marco Argentieri, Andrew Camilleri, and Dmitry Petukhov, Fuji combines a catalog of Bitcoin and layer-2 technologies like Liquid opcodes, Taproot, and Lightning submarine swaps to authorize borrowing against over-collateralized positions.

Curation

Asset support will be based on the community's feedback and demand, asset liquidity, and the availability of reputable oracles. If you would like to participate in those discussions or recommend an asset type, join the Fuji Telegram channel.

FUJI USD (FUSD), a bitcoin-backed stablecoin pegged to the US dollar, will be the first Fuji asset available. Users can borrow FUSD by depositing bitcoin inside a Liquid smart contract (i.e., a covenant address) using a Lightning submarine swap or directly with L-BTC.

The team already has plans to extend the protocol to other asset classes, such as collateral-backed synthetic stocks whose price is determined by a reference index via an oracle.

Assets

A synthetic asset, or synth, can be defined as anything an oracle can attest to, from regulated security tokens like the Blockstream Mining Note or a share of Apple stock to entire index funds like the S&P 500 or a particular ETF.

It works by having the user (borrower) lock collateral into a Liquid smart contract to borrow the synthetic asset, which acts as a digital bearer asset on Liquid that can then be self-custodied and traded confidentially between peers.

In the future, as long as a reputable oracle is available, users could potentially create their own basket of assets, too. Fuji is expected to tap Blockstream's Cryptocurrency Data Feed for its price APIs at the beginning and has plans to expand the number of oracle parties as soon as they become available for greater price resilience and accuracy.

DYOR

When announced, there were some initial questions about Fuji's risk profile given the recent blowup of Terra Luna and the bankruptcy of Celsius, both of which suffered from the volatile price swings in the crypto market that eventually culminated with over-leveraged assets going underwater.

Before we jump into the protocol, it is important to DYOR and to understand Fuji is still in the development stage (at the time of publication) and that certain aspects of the trading infrastructure or terms may change with time. The research paper here (embedded earlier in the blog) does an excellent job highlighting some of the risks involved with lending, such as the possibility of real-world attacks or poor oracle performance. The paper also touches on potential solutions to those problems.

Fortunately, the guys over at Fuji seem to be taking a risk-averse approach to their lending strategy and are committed to building a reliable, robust protocol.

Protocol

Let's explore some of the finer points of Fuji's protocol, especially in the context of mitigating risk.

First, Fuji's minimum collateral coverage ratio (CCR) is 150%, or 1.5, significantly more over-collateralized than the industry standard of 110%, or 1.1, to lower lender risk. Users can also continually increase their margins by adding more collateral at any time via a 'collateral top-up.'

Once a contract's collateral approaches a dangerous level (e.g., during a BTC price crash), the borrower will be notified of the price decrease and be recommended to close or top up. The liquidator (Fuji) can step in and confiscate the collateral, but only if they burn the equivalent amount of Fuji assets.

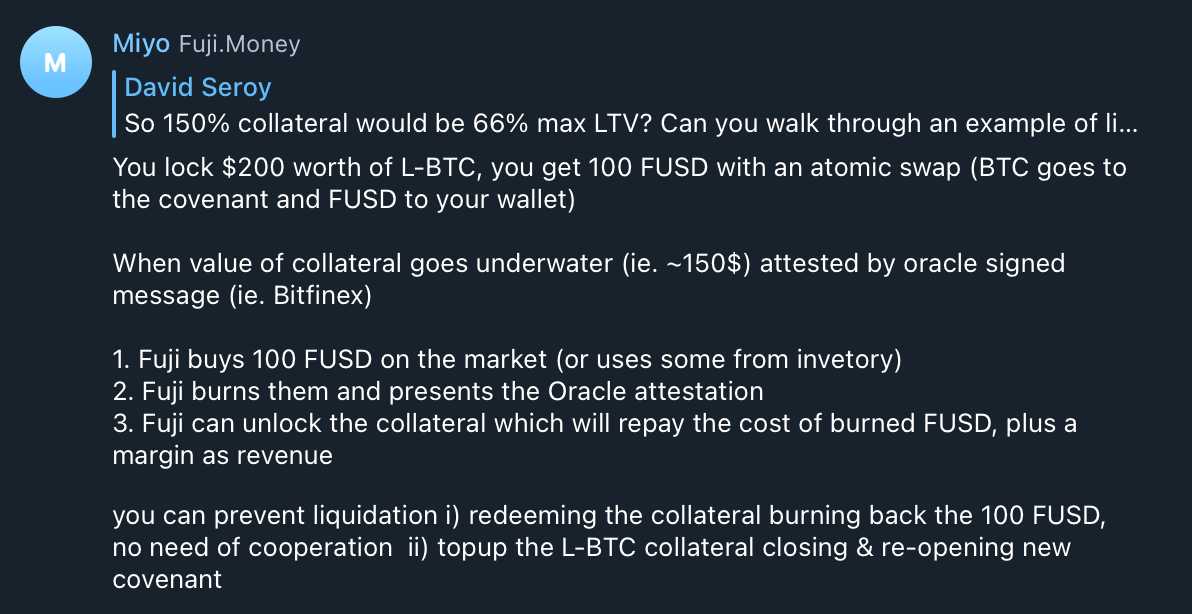

The actual liquidation process, however, is performed as soon as the value of the collateral is below the minimum collateralization requirement (<150%), and an oracle attests that with a signature.

Second, users maintain custody of their funds with Fuji, allowing them to not only self-custody their assets off-platform in a Liquid wallet of their choice, but if Fuji were ever to become insolvent, users could still unlock their collateralized assets.

A redemption fee of 0.25% of the collateral asset when unlocking is currently the only cost for the end-user. There is no interest rate for borrowing or other associated fees, but this may change as the platform matures.

And that's only 0.25%?

— Joe Burnett (🔑)³ (@IIICapital) June 2, 2022

Effectively, this enables people to borrow USD at 0% perpetually using the world's best monetary good as collateral. If true and stable, this could spark the ultimate speculative attack against fiat currencies.

In addition to self-custodying their assets, users choose all contract parameters, such as the collateralized asset and CCR (>=150%). Fuji only acknowledges the collateral satisfies the requested amount and uses a re-issuance token to make a new issuance.

Third, unlike other projects that use a pooling mechanism, the minting of each asset happens on a per contract basis under a UTXO model, reducing systematic risk and the chance of a domino effect.

Another advantage is that the contract rules can be tailored individually, allowing for greater flexibility and adjustment. Possible bugs or exploits are also inherently siloed under the model, providing extra protection for some scenarios, like when upgrading contracts.

Fourth, the asset's issuance and burning are done non-confidentially on the Liquid blockchain for immutable verifiability.

Once issued, Liquid's Confidential Transactions become the default transaction method again, blinding asset type and the amount. The liquidation target price also remains hidden due to the contract's Taproot address, further conserving investor privacy and lowering liquidation risk.

When a liquidation price is public and telegraphed on-chain like with Celsius and other DeFi platforms built on altcoins, attackers know precisely how much to push down the price to force liquidations. Taproot prevents this from happening on Fuji.

Miyo at Fuji summed up the liquidation process like this:

LiFi

In an era of digital despotism, decentralized and trust-minimized finance is required infrastructure for a free society. This remains true in a future where Bitcoin is the dominant global store of wealth. Modern financial products and services will need a home on the Bitcoin standard, and the layer-2 applications leveraging Lightning and Liquid will be the vanguards for this reformation of capital markets.

Those interested in being part of that future can get early access to Fuji now by joining the closed beta, which will onboard the first ten users on the waitlist starting August 1.

For the latest discussions and updates, join the Fuji Telegram channel and follow the official Twitter account. The new Liquid subreddit is also a great resource to fall back on for questions.

Stay on the Bleeding-Edge of Bitcoin

Subscribe below to have future issues of the Layer-2 Report and the latest news from our engineering, research and mining teams delivered to your inbox.

You can also follow us @Blockstream and the #LAYER2ROUNDUP (now #LAYER2REPORT) hashtag for a Twitter-friendly version of the roundup each month.

This article has been prepared solely for informational purposes only. It does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to any exemption or registration under the securities laws of any such state or jurisdiction.

We will never reach out directly to investors through social media or instant messaging. If you receive any messages from someone claiming to be from Blockstream and offering mining investments, report them to us through the Blockstream Scam DB.