In this latest update, we cover key technical progress, product launches, research breakthroughs, media wins and commercial successes throughout the last quarter, highlighting Blockstream’s increasingly important role at the intersection of Bitcoin and traditional finance.

Major Q2 2025 Highlights

Q2 2025 marked a pivotal chapter for Blockstream, underscored by the unveiling of a renewed strategic vision and a powerful new tagline: The Future of Finance Runs on Bitcoin. Announced by Blockstream co-founder and CEO Dr. Adam Back during his keynote at Bitcoin 2025 in Las Vegas, this new roadmap defines our future direction across all three core business verticals—Consumer, Enterprise and Finance.

Other major highlights include:

- Blockstream App Launches: A redesigned, unified wallet experience is rolled out globally in Las Vegas, featuring simplified onboarding, integrated Bitcoin purchasing, and seamless Jade support

- Research Breakthroughs: Blockstream Research advances Bitcoin’s security and scalability with DahLIAS (signature aggregation), ChillDKG (threshold multisig), and Shielded CSV (privacy-preserving script upgrades)

- Milestone Core Lightning Release: v25.05 “Satoshi’s OP_RETURN Opinion” delivers major performance gains, LSPS support, and enhanced developer tooling

- Liquid Ecosystem Growth: The Liquid Federation expands to 81 members, and TVL surpasses $3.27 billion. Meanwhile, finishing touches were completed ahead of last week’s launch of Simplicity, marking a milestone in Bitcoin-native programmable finance.

Blockstream Finance: Advancing the Institutional Bitcoin Thesis

Blockstream Finance continued its strong trajectory in Q2 2025, capitalizing on accelerating demand from allocators, pension funds, family offices, and asset managers seeking secure, regulated exposure to Bitcoin. Building on the significant institutional interest generated by the January unveiling of Blockstream Asset Management (BAM)’s inaugural funds, which Blockstream Finance will sub-advise, the funds will serve as a cornerstone of Blockstream’s broader strategy to bridge Bitcoin and traditional finance.

Throughout the quarter, Blockstream CEO Dr. Adam Back and CIO Sean Bill engaged directly with key decision-makers through a series of high-profile, institution-focused panels and fireside chats worldwide.

In May, for example, the pair embarked on a coast-to-coast US tour, with highlights including appearances at the SACRS public pension conference in California, a private gathering at the Coronado Club in Houston, and discussions at Talking Hedge and Bitcoin Park in Austin. Adam and Sean were also honored to join an event organized by the Texas Blockchain Council, coinciding with the passage of Texas’ long-awaited Bitcoin Reserve Bill and will be speaking at the upcoming TexPERS conference in El Paso.

A full recap of the US tour, which concluded with Adam’s participation in a panel alongside leaders from Pantera Capital, Grayscale, and KAUST Investment Management at iConnections Global Alts conference in New York, can be found here.

At Bitcoin 2025, Blockstream CEO @adam3us took the Nakamoto Stage to deliver a message loud and clear:

— Blockstream (@Blockstream) June 3, 2025

The Future of Finance Runs on Bitcoin.

From Bitcoin’s cypherpunk roots to its institutional ascent, Adam laid out the vision for where we go next and how Blockstream is… pic.twitter.com/YzMdQau0hH

A major highlight of the quarter ultimately came at Bitcoin 2025 in Las Vegas, where Adam unveiled Blockstream’s renewed strategic vision and new tagline, The Future of Finance Runs on Bitcoin. In his keynote, Adam highlighted Blockstream Finance as one of three core business units set to shape the company’s future, alongside our consumer and enterprise verticals. Sean also took to the stage in Vegas with a keynote of his own, Why Sophisticated Investors Should Consider an Allocation to Bitcoin, offering a compelling, data-driven case for institutional adoption.

Last month at BTC Prague meanwhile, Adam sat down with Strategy’s Michael Saylor for a historic fireside chat on Bitcoin’s long-term trajectory and the institutional path ahead.

With Blockstream Finance now firmly established as a strategic growth engine, the team continues to explore new products that meet the evolving needs of institutional allocators, supporting Bitcoin’s emergence as the foundation for a more open, resilient global financial system.

Core Lightning: Powerful New Capabilities

Q2 2025 saw another milestone release for Core Lightning (CLN) with v25.05 “Satoshi’s OP_RETURN Opinion” delivering performance improvements, expanded developer tooling, and broader protocol support—all designed to push the Lightning Network toward greater reliability and scalability.

Core Lightning v25.05 “Satoshi’s OP_RETURN Opinion” is out now!

— Core Lightning ⚡️ (@Core_LN) June 17, 2025

This release brings smoother payments, reduced latency, Reckless plugin upgrades, splicing improvements, early LSPS support, and new developer APIs.

Download, test, and let us know what you build! ⬇️ pic.twitter.com/M1BcF29AHN

Highlights of the release include a significant latency reduction during pathfinding and payment execution, delivering a snappier and more responsive user experience. The popular Reckless plugin suite also received key updates, extending its utility for node operators looking to customize or experiment at the edges of Lightning’s capabilities.

One of the most notable enhancements was early support for the Lightning Service Provider Specification (LSPS), marking an important step toward improving liquidity provisioning and interoperability between LSPs and wallets. The release also enabled peer storage by default, making it easier for developers and power users to manage metadata associated with channel peers across restarts and deployments.

As Bitcoin’s scalability layer continues to evolve, Core Lightning remains focused on delivering a modular, production-ready implementation tailored to real-world use. The roadmap for the second half of the year includes expanded LSPS capabilities, improved mobile integration, and ongoing optimization for enterprise-grade reliability.

Greenlight: Scaling Lightning for Enterprises

While the official launch of Greenlight v0.3.1 came just after the close of Q2, much of the engineering work that made the release possible took place in the background over the preceding months. The latest version now runs on Core Lightning v25.05, bringing Greenlight in line with the most recent performance, protocol, and reliability upgrades.

Greenlight 0.3.1 by the @Blockstream Lightning team is here.

— Greenlight (@BlksGreenlight) July 16, 2025

This non-custodial service lets you hold your keys while we handle the node operations behind the scenes.

Nodes now run @Core_LN v25.05 with the latest performance, protocol, and reliability improvements. pic.twitter.com/Yho5eJYoze

Greenlight remains a cornerstone of Blockstream’s enterprise and developer strategy for Lightning. By separating key custody from node operations, it enables apps, exchanges, and services to offer trust-minimized Lightning functionality with minimal infrastructure burden.

As adoption of Lightning accelerates, Greenlight is steadily evolving into the go-to solution for scalable, secure, non-custodial integrations, offering a powerful path forward for developers building the next generation of Bitcoin applications.

Blockstream Research: Advancing Bitcoin’s Frontiers

Q2 2025 was a prolific quarter for Blockstream Research, with breakthroughs including the unveiling of DahLIAS, the first cryptographic protocol for full cross-input signature aggregation using Bitcoin’s native secp256k1 curve. DahLIAS introduces 64-byte aggregate signatures with two-round signing and nearly double the verification speed of half-aggregated Schnorr, marking a potential leap forward in transaction efficiency and scalability.

At the Real World Crypto conference in Bulgaria, Research Lead Jonas Nick presented ChillDKG, a draft BIP proposing a simpler and more secure approach to Distributed Key Generation (DKG) for threshold wallets, long a stumbling block in multi-party signing schemes. ChillDKG could pave the way for wider adoption of robust multisig protocols like FROST.

Also at Bitcoin 2025, Jonas shared a first look at Shielded CSV, a new privacy-preserving upgrade built with collaborators from Alpen Labs and ZeroSync. Shielded CSV aims to enhance Bitcoin’s privacy model by enabling verifiable yet opaque spending conditions, an elegant step toward better confidentiality at the protocol level.

The programming language subgroup of Blockstream Research also made meaningful progress in Q2 releasing new tooling for Simplicity, including the hal-simplicity CLI tool, as well as finalizing “SimplicityHL” as the official name for its high-level language, previously known by the codename Simfony. They also introduced secp256k1lab, a Python-based educational toolkit for elliptic curve cryptography, and prepared version 1.0 release candidates for both the bitcoin-units and hex-conservative libraries.

Each of these efforts reflects Blockstream’s ongoing commitment to responsible innovation: building tools that extend Bitcoin’s capabilities while remaining faithful to its core values of decentralization and security.

Jade & the All-New Blockstream App: Expanding Global Self-Custody

Q2 marked a significant leap forward for Blockstream’s consumer offering, with the launch of the all-new Blockstream App: a unified Bitcoin wallet designed to grow with users from their first sats to advanced self-custody. Built to work seamlessly with Jade, the app reflects our sharpened focus on delivering best-in-class UX without compromising on decentralization or privacy.

Introducing the Blockstream App: a new Bitcoin wallet that grows with you.

— Blockstream (@Blockstream) May 29, 2025

From first sats to advanced custody, it brings self-sovereignty into reach no matter where you start. Available now on Android, coming soon to iOS. ? pic.twitter.com/UBiNHKh8bO

Highlights of the new Blockstream App include:

- A redesigned interface for simpler navigation across multiple wallets and network types (Bitcoin, Lightning, Liquid)

- A streamlined onboarding process with guided setup for new users,

- And worldwide rollout of Buy Bitcoin, allowing users to purchase Bitcoin directly to self-custody in over 200 currencies

The app’s debut followed closely on the heels of a Bitcoin Pizza Day event co-hosted alongside PubKey in New York, which saw Blockstream donate 1,000 Jade devices to Mi Primer Bitcoin as part of our renewed Blockstream Local initiative. This campaign aims to make Bitcoin education and tools more accessible globally, particularly in communities where self-custody can have a life-changing impact.

Looking ahead, the Blockstream development team remains hard at work delivering new features to make the Blockstream App and Blockstream Jade the most secure and user-friendly way for people to manage their bitcoin.

Liquid: Ecosystem Momentum Grows

The Liquid Network, with Blockstream as the technical provider, continued to mature in Q2, cementing its position as Bitcoin’s leading platform for tokenized asset issuance and confidential settlement.

On the infrastructure side, the final touches were added in preparation for last week’s launch of Simplicity, marking a new era of programmable finance on Bitcoin. While early use cases remain exploratory, Simplicity lays the groundwork for more expressive, formally specified smart contracts in Bitcoin-native environments, enabling potential applications ranging from structured financial products to automated loan servicing.

The Liquid Federation also saw continued expansion, welcoming several new members and formally electing its 2025 board members. The network now comprises 81 member enterprises, underscoring Liquid’s role as a neutral, robust layer for Bitcoin capital markets. Meanwhile, Total Value Locked (TVL) on the network recently surpassed $3.27 billion, driven by demand for secure settlement, asset issuance, and integrations with institutional-grade infrastructure.

The most recent Liquid Developer Bootcamp has concluded in Bulgaria! Over the course of two days, a new group of developers joined us at the University of Plovdiv to learn the fundamentals and tech stacks for building on Bitcoin and its second layers, Lightning and Liquid. ⚡️? pic.twitter.com/LHbLk53Yn0

— Liquid Network ? (@Liquid_BTC) May 21, 2025

Outreach and developer education efforts also ramped up. Blockstream recently hosted intensive Liquid Developer Bootcamps in Argentina and Bulgaria, helping onboard the next generation of Bitcoin builders across Europe. These initiatives form part of our ongoing commitment to nurturing a healthy, open ecosystem for Bitcoin-native financial innovation.

Strategic Engagement & Business Development

Building on Q2 efforts to expand our footprint in Europe, Blockstream completed the acquisition of Swiss-based Elysium Lab in July, establishing Blockstream CH SAGL as our new European headquarters and a launchpad for regional R&D.

As part of the acquisition, members of the Elysium team have joined Blockstream in key roles across engineering, business development, and product, strengthening our presence on the ground and aligning with our broader vision for global Bitcoin-native infrastructure.

Big news from Switzerland ??

— Blockstream (@Blockstream) July 21, 2025

We’ve acquired Elysium Lab (@ElysiumLab_io) and launched our new Blockstream European HQ in Lugano.

This expands our presence in Europe and deepens our commitment to building Bitcoin infrastructure across the region.

?⬇️ pic.twitter.com/Oy5fAG217v

Based in Lugano, the new acquisition strengthens Blockstream’s long-term commitment to Switzerland’s world-class fintech ecosystem. Paired with the opening of our regional headquarters in Tokyo earlier this year, it marks a major step forward in our mission to support local partners, accelerate technical collaboration, and advance Bitcoin-native innovation in key global markets.

Beyond our growing presence in Europe, Blockstream continued to deepen enterprise engagement globally. Enterprise grade custody, treasury solutions, stakeholder sidechains and Liquid-based tokenization have been the dominant topics.

As demand increases for Bitcoin-native infrastructure, Blockstream remains the trusted partner for institutions building on the world’s most secure monetary network.

Media Highlights

Q2 2025 was a record-breaking quarter for media engagement, with Blockstream capturing headlines across both mainstream and crypto media, highlights including:

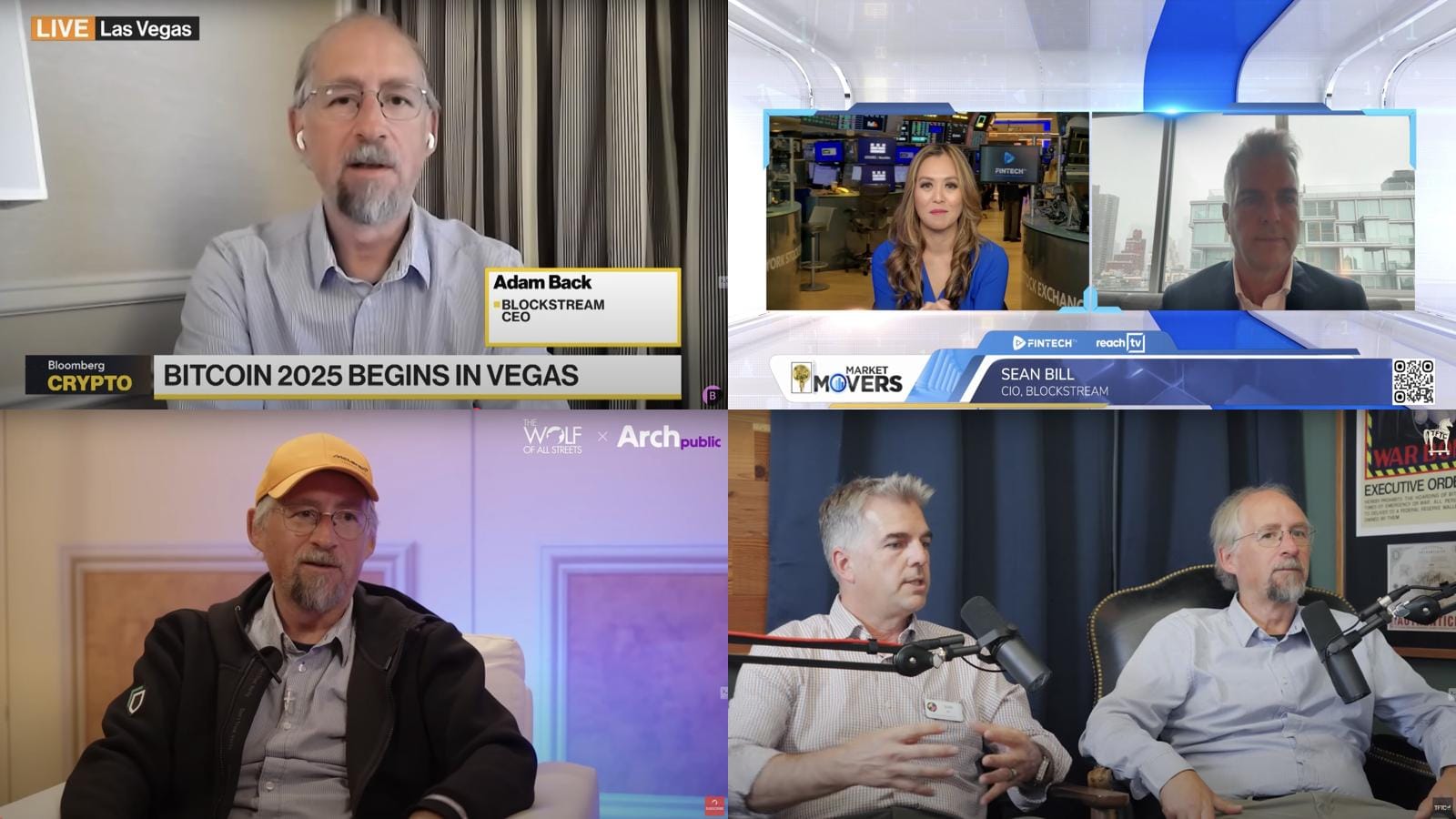

- Adam and Sean’s appearances on TV, including with Bloomberg Crypto, Fintech.tv and Roxom TV

- Coverage of Blockstream’s renewed strategic vision and launch of the Blockstream App at Bitcoin 2025 in Bitcoin Magazine, BeInCrypto and BTC Times

- Reporting on the Liquid Network surpassing $3.27 billion in TVL from Bitcoin Magazine and The Block, reflecting surging demand for Bitcoin-native tokenization and settlement.

- Coindesk’s reporting on Blockstream’s acquisition of Elysium Lab and the launch of our new European headquarters

- Long-form interviews with and commentary from Adam touching on everything from Bitcoin treasuries to market cycles from the likes of Cointelegraph, Decrypt and BTC-Echo.

- Podcast interviews with Adam and Sean across high-visibility channels including TFTC, Unchained’s The Bitcoin Frontier, The Mark Moss Show, The Wolf of All Streets, and Cointelegraph’s Decentralize!.

- One-on-one briefings with tier-1 media, including The Wall Street Journal, Bloomberg, and The New York Times, supporting Blockstream’s positioning as a leader in institutional Bitcoin adoption.

Looking Ahead: Q3 2025 Priorities

With Q3 2025 underway, we remain focused on advancing Bitcoin’s financial infrastructure, scaling layer-2 solutions, and deepening institutional and enterprise engagement.

Our priorities for the coming months include:

- Blockstream Finance: Continued exploration and development of new institutional-grade investment products while deepening engagement with allocators, pensions and other entities, including corporate treasuries.

- Core Lightning & Greenlight: Expand LSPS integration, mobile optimizations, and enterprise-focused Lightning deployments.

- Consumer: Roll out additional security and UX features for the Blockstream App and Jade to strengthen self-custody.

- Enterprise: Expand global enterprise product suite and formalize strategic partnerships for revenue sharing with application developers. Formalize regional beachheads, e.g., leveraging Blockstream CH SAGL as a hub for European collaboration. Accelerating revenue recognition via hybrid consulting/product development agreements with enterprise clients. Focus on driving TVL and liquidity through the global adoption of Bitcoin-native infrastructure including Liquid.

We remain committed to our long-term mission: building a financial system that runs on Bitcoin, and creating developer partnerships to pursue global consumer and enterprise adoption.

For more information, visit blockstream.com, or reach out to press@blockstream.com or @Blockstream on ?.