The Blockstream Mining Note 2 (BMN2) is now available on digital asset marketplace STOKR from today. It offers qualified non-US investors direct exposure to hashrate generated at our mining facilities through a tradeable security token issued on the Liquid Network.

BMN2 builds on the success of its predecessor, BMN1, by offering a similar structure but over a longer period of 48 months. BMN1 recently reached maturity, generating over 1,212 BTC (~7.76 BTC per BMN1) with net returns of up to 102% over its three-year term.

Greater Participation in Mining

As a hashrate-backed security token, BMN2 removes many of the challenges aspiring miners have when managing operations. This includes the technical complexities and risks associated with procuring efficient ASICs, accessing low-cost energy sources, and building specialized facilities that require continual upkeep and maintenance.

By removing these barriers of entry to mining, individuals can participate more easily in Bitcoin's underlying proof of work protocol, contributing to its overall security, censorship resistance and decentralization.

Proven Track Record

The inaugural Blockstream Mining Note, BMN1, set a high benchmark in the Bitcoin mining investment sector. Some of these key highlights include:

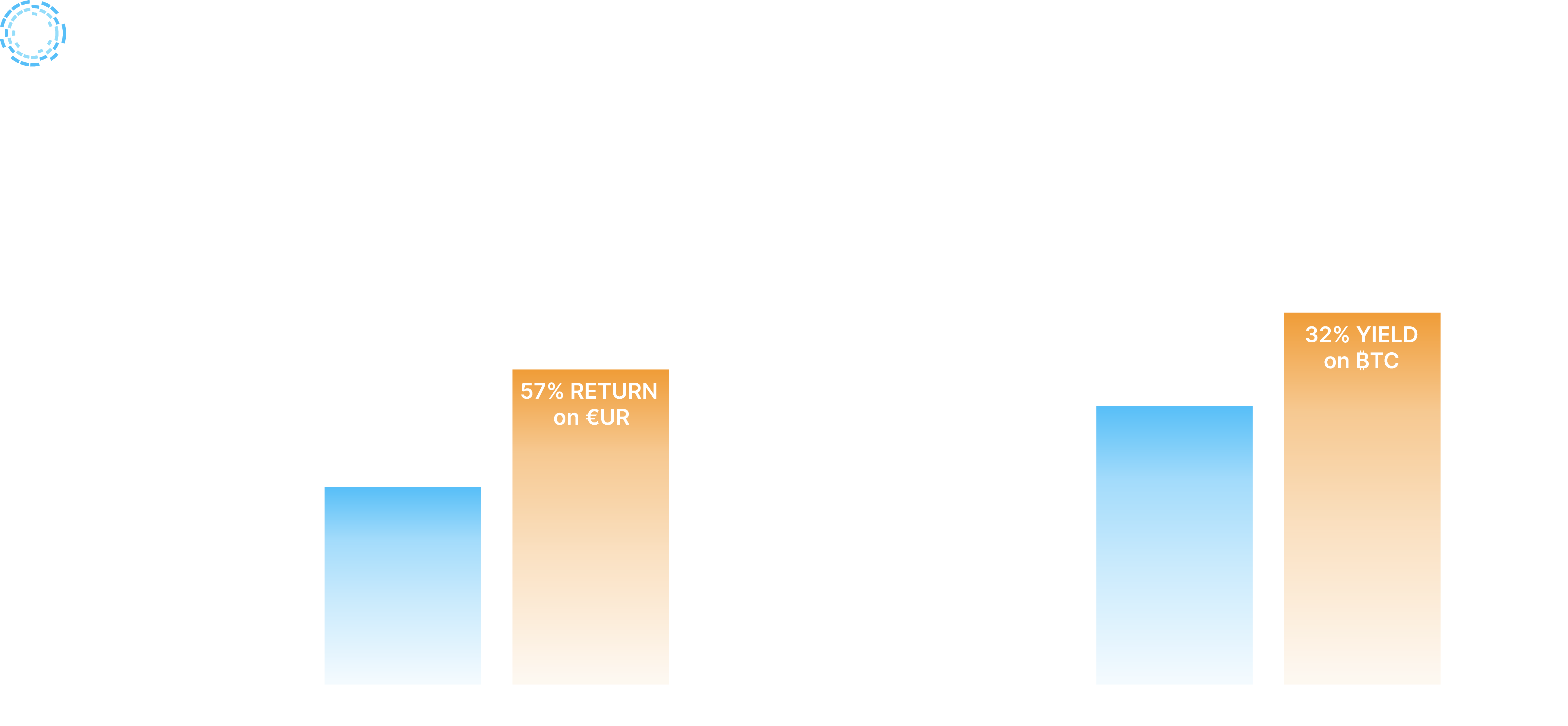

- Return on Investment: BMN1 generated a net return of approximately 57% based on the average BMN1 price of €258,185, resulting in a net return of €405,107 per BMN1.

- Bitcoin-Denominated Returns: The investment yielded a net 32% bitcoin-on-bitcoin return, producing 295 BTC.

- Market Outperformance: Both the net EUR and BTC performances surpassed the returns of direct Bitcoin spot market purchases, highlighting BMN’s alpha-generating potential.

- Greater Liquidity: Investors benefited from improved liquidity through the security token structure, enabling them to dynamically adjust their Bitcoin mining exposure through P2P trades and secondary markets, including Bitfinex Securities, MERJ Exchange, and SideSwap. A total of 6.5 BMN1 were traded on SideSwap and 37.41 BMN1 were traded P2P at undisclosed prices, with an estimated trading volume of €18.23M.

- Transparency: Investors had access to real-time performance via an automated daily reporting system on the BMN1 dashboard, complemented by weekly email updates.

- Risk-Adjusted Returns: By providing exposure to Bitcoin mining without the operational risk and expertise, BMN1 offered a unique risk-reward profile for investors seeking diversification in their Bitcoin mining investments.

- Institutional-Grade Security: BMN1 leveraged Blockstream's enterprise-level mining facilities in North America, with advanced power cooling and 24/7 on-site security. Mined bitcoin was also securely stored in cold storage until the maturity of the three-year term.

For more information on BMN1 performance, please refer to STOKR's extensive Blockstream Mining Note report.

Discussion of the BMN1, its performance, and impact on the broader ecosystem.

Leverage Historically Low Hashprice

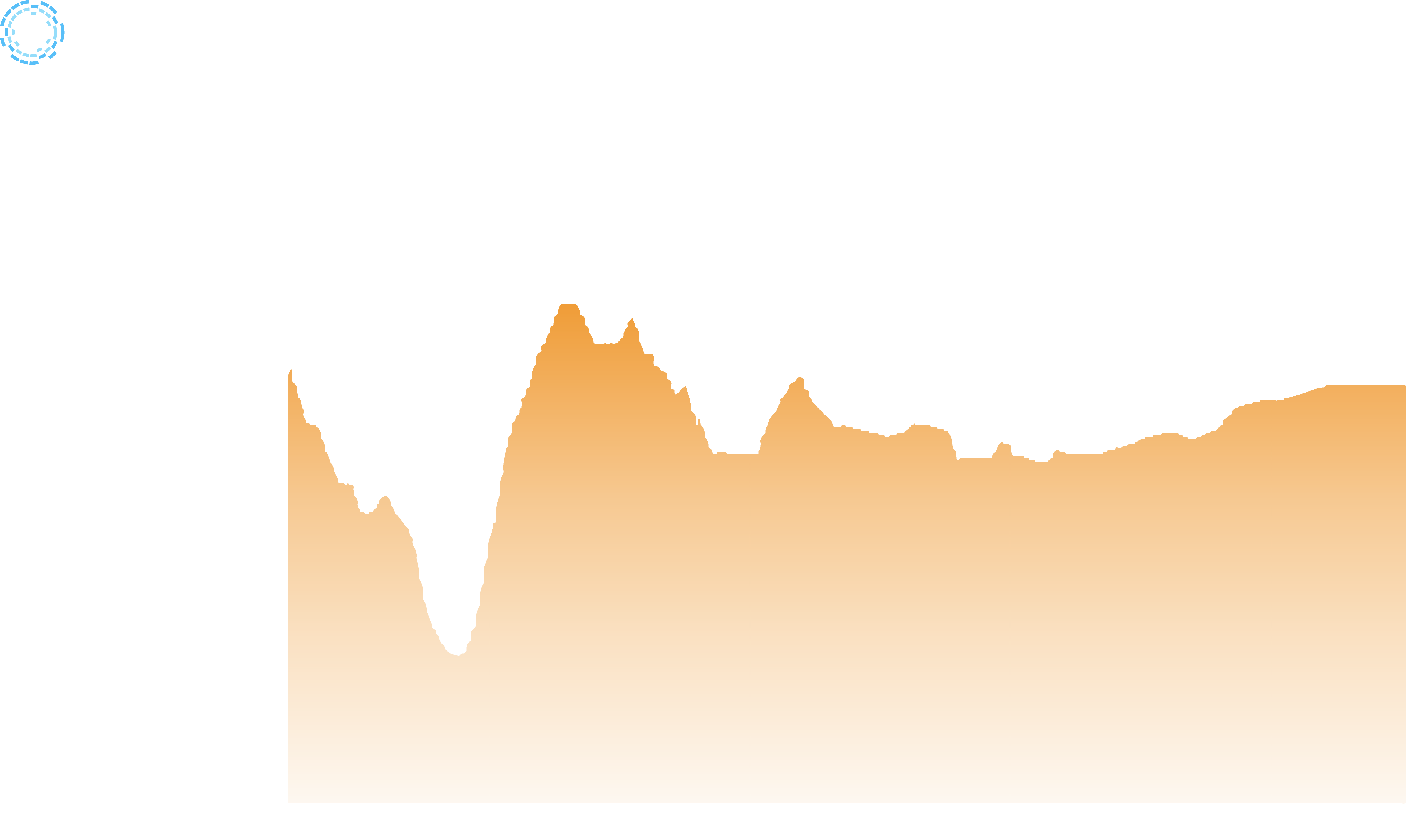

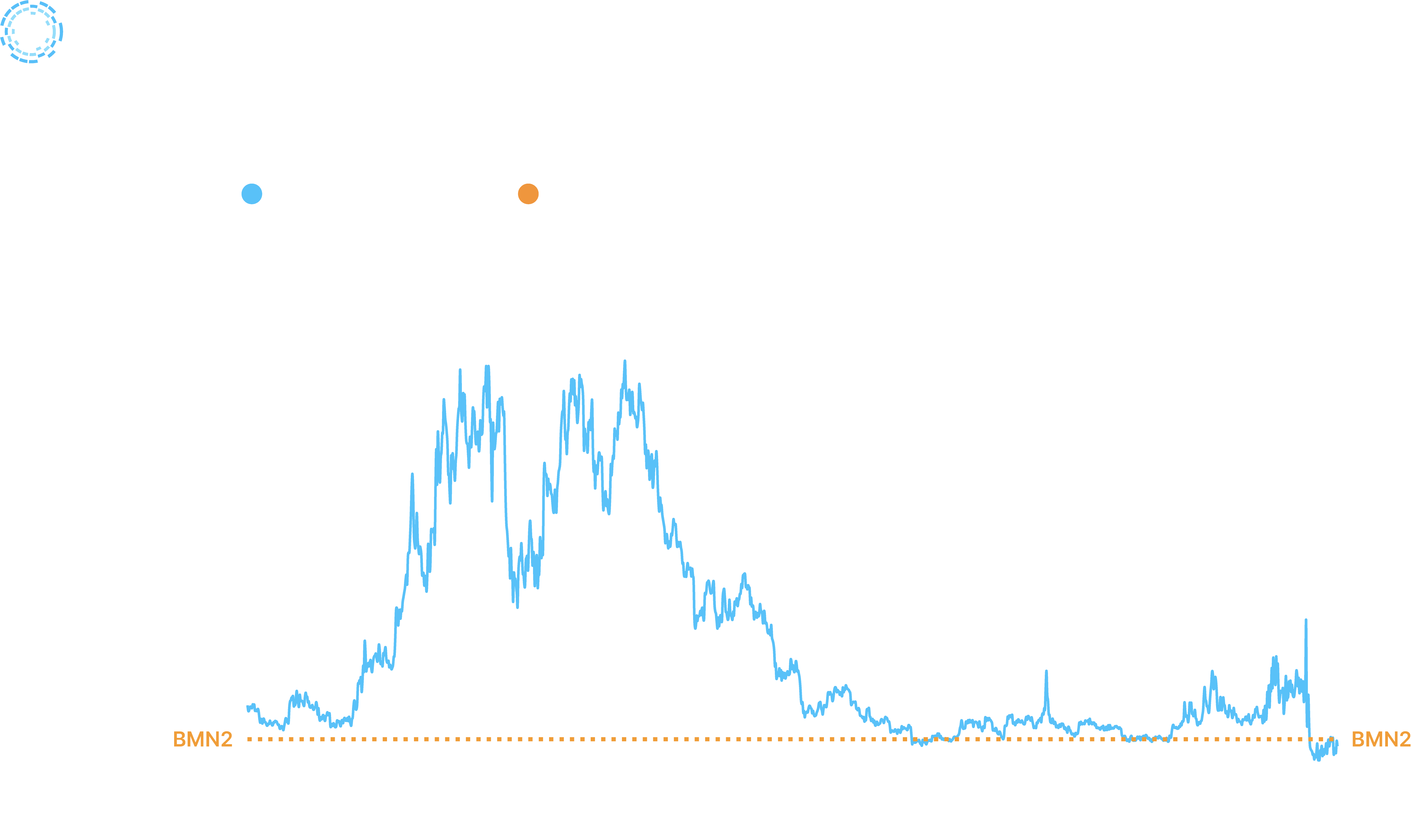

BMN2 takes the learnings and best practices from BMN1 to provide investors with an attractive entry point into a new Bitcoin market cycle, characterized by historically low hashprice levels.

Hashprice, a key metric in Bitcoin mining, represents the profitability of mining operations and is typically measured in dollars per petahash per second per day (USD/PH/s/Day). Currently, the hashprice of Bitcoin stands at approximately $53 per PH/s. In this context, BMN2 offers investors a unique opportunity by enabling investors to lock in a favorable hashprice of $61.64 per PH/s for an extended 48-month term.

BMN2 becomes particularly attractive when considering historical data from the past four years, which shows that the global hashprice has frequently exceeded BMN2's locked hashprice, indicating potentially lucrative periods for investors.

By investing upfront at a fixed and comparatively low hashprice of $61.64 per PH/s, investors position themselves to benefit from the expected new highs in Bitcoin price and higher fee markets associated with bull markets. This investment strategy capitalizes on the dynamic nature of the Bitcoin market while mitigating some of the risks associated with fluctuating mining profitability.

Series 1 of BMN2

We will partner again with Luxembourg-based virtual asset service provider STOKR for BMN2's first series, which will run from July 18 to August 12, 2024. Unlike previous offerings, BMN1 investors will be able to directly roll over from BMN1 to BMN2, making them eligible for a 3% bonus in additional BMN2 securities.

Each BMN2 entitles holders to the bitcoin produced by 1 PH/s of hashrate at our North American mining operations for a 48-month term at $90,000 per BMN2. The offering is open to non-US qualified investors with a minimum investment of $115,000 or $10,000 for professional investors or the equivalent in BMN1 (via rollover), Bitcoin (BTC), Liquid Bitcoin (LBTC), Tether (USDT), USD, or EUR.

Prospective investors and members of the press can contact our team on the Blockstream site for further questions or join us on the Blockstream Finance Telegram to discuss the BMN investment thesis and overall Bitcoin market.

To register for the BMN2 offering, please visit STOKR’s investment page.

The information above has been prepared solely for informational purposes only. It is not an offer to buy or sell or a solicitation of an offer to buy or sell any securities. Full terms and conditions are available on STOKR.

We will never contact investors directly through social media or instant messaging. If you receive messages from someone claiming to be from Blockstream and offering mining investments, report them to us through the Blockstream Scam DB.